Communicated to the House of Representatives,

January 14, 1790.

Treasury Department,

January 9, 1790.

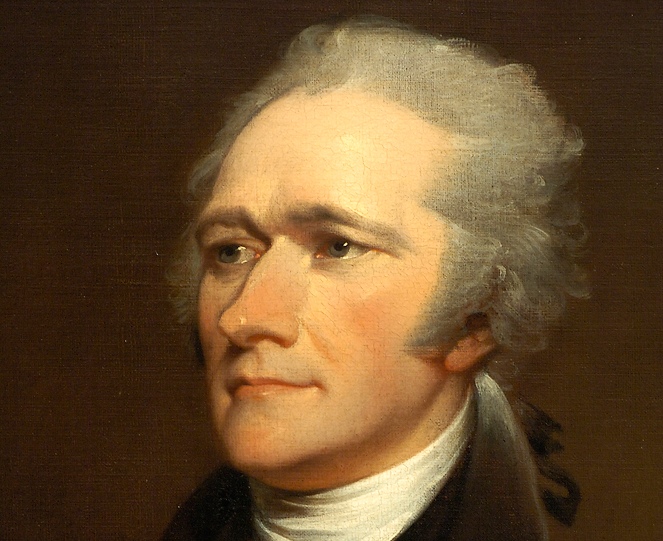

The Secretary of the Treasury, in obedience to the resolution of the House of Representatives of the twenty-first day of September last, has, during the recess of Congress, applied himself to the consideration of a proper plan for the support of the public credit, with all the attention which was due to the authority of the House, and to the magnitude of the object.

In the discharge of this duty, he has felt, in no small degree, the anxieties which naturally flow from a just estimate of the difficulty of the task, from a well-founded diffidence of his own qualifications for executing it with success, and from a deep and solemn conviction of the momentous nature of the truth contained in the resolution under which his investigations have been conducted,—“That an adequate provision for the support of the public credit is a matter of high importance to the honor and prosperity of the United States.”

With an ardent desire that his well-meant endeavors may be conducive to the real advantage of [228] the nation, and with the utmost deference to the superior judgment of the House, he now respectfully submits the result of his inquiries and reflections to their indulgent construction.

In the opinion of the Secretary, the wisdom of the House, in giving their explicit sanction to the proposition which has been stated, cannot but be applauded by all who will seriously consider and trace, through their obvious consequences, these plain and undeniable truths:

That exigencies are to be expected to occur, in the affairs of nations, in which there will be a necessity for borrowing.

That loans in time of public danger, especially from foreign war, are found an indispensable resource, even to the wealthiest of them.

And that, in a country which, like this, is possessed of little active wealth, or, in other words, little moneyed capital, the necessity for that resource must, in such emergencies, be proportionably urgent.

And as, on the one hand, the necessity for borrowing in particular emergencies cannot be doubted, so, on the other, it is equally evident that, to be able to borrow upon good terms, it is essential that the credit of a nation should be well established.

For, when the credit of a country is in any degree questionable, it never fails to give an extravagant premium, in one shape or another, upon all the loans it has occasion to make. Nor does the evil end here; the same disadvantage must be sustained on whatever is to be bought on terms of future payment.

[229]

From this constant necessity of borrowing and buying dear, it is easy to conceive how immensely the expenses of a nation, in a course of time, will be augmented by an unsound state of the public credit.

To attempt to enumerate the complicated variety of mischiefs, in the whole system of the social economy, which proceed from a neglect of the maxims that uphold public credit, and justify the solicitude manifested by the House on this point, would be an improper intrusion on their time and patience.

In so strong a light, nevertheless, do they appear to the Secretary, that, on their due observance, at the present critical juncture, materially depends, in his judgment, the individual and aggregate prosperity of the citizens of the United States; their relief from the embarrassments they now experience; their character as a people; the cause of good government.

If the maintenance of public credit, then, be truly so important, the next inquiry which suggests itself is: By what means is it to be effected? The ready answer to which question is, by good faith; by a punctual performance of contracts. State, like individuals, who observe their engagements are respected and trusted, while the reverse is the fate of those who pursue an opposite conduct.

Every breach of the public engagements, whether from choice or necessity, is, in different degrees, hurtful to public credit. When such a necessity does truly exist, the evils of it are only to be palliated by a scrupulous attention, on the part of the Government, to carry the violation no further than [230] the necessity absolutely requires, and to manifest, if the nature of the case admit of it, a sincere disposition to make reparation whenever circumstances shall permit. But, with every possible mitigation, credit must suffer, and numerous mischiefs ensue. It is, therefore, highly important, when an appearance of necessity seems to press upon the public councils, that they should examine well its reality, and be perfectly assured that there is no method of escaping from it, before they yield to its suggestions. For, though it cannot safely be affirmed that occasions have never existed, or may not exist, in which violations of the public faith, in this respect, are inevitable; yet there is great reason to believe that they exist far less frequently than precedents indicate, and are oftenest either pretended, through levity or want of firmness; or supposed, through want of knowledge. Expedients often have been devised to effect, consistently with good faith, what has been done in contravention of it. Those who are most commonly creditors of a nation are, generally speaking, enlightened men; and there are signal examples to warrant a conclusion that, when a candid and fair appeal is made to them, they will understand their true interest too well to refuse their concurrence in such modifications of their claims as any real necessity may demand.

While the observance of that good faith, which is the basis of public credit, is recommended by the strongest inducements of political expediency, it is enforced by considerations of still greater authority. [231] There are arguments for it which rest on the immutable principles of moral obligation. And in proportion as the mind is disposed to contemplate, in the order of Providence, an intimate connection between public virtue and public happiness, will be its repugnancy to a violation of those principles.

This reflection derives additional strength from the nature of the debt of the United States. It was the price of liberty. The faith of America has been repeatedly pledged for it, and with solemnities that give peculiar force to the obligation. There is, indeed, reason to regret that it has not hitherto been kept; that the necessities of the war, conspiring with inexperience in the subjects of finance, produced direct infractions; and that the subsequent period has been a continued scene of negative violation or non-compliance. But a diminution of this regret arises from the reflection, that the last seven years have exhibited an earnest and uniform effort, on the part of the Government of the Union, to retrieve the national credit, by doing justice to the creditors of the nation; and that the embarrassments of a defective Constitution, which defeated this laudable effort, have ceased.

From this evidence of a favorable disposition given by the former Government, the institution of a new one, clothed with powers competent to calling forth the resources of the community, has excited correspondent expectations. A general belief accordingly prevails, that the credit of the United States will quickly be established on the firm foundation of an effectual provision for the existing debt. [232] The influence which this has had at home is witnessed by the rapid increase that has taken place in the market value of the public securities. From January to November, they rose thirty-three and a third per cent.; and, from that period to this time, they have risen fifty per cent. more; and the intelligence from abroad announces effects proportionably favorable to our national credit and consequence.

It cannot but merit particular attention, that, among ourselves, the most enlightened friends of good government are those whose expectations are the highest.

To justify and preserve their confidence; to promote the increasing respectability of the American name; to answer the calls of justice; to restore landed property to its due value; to furnish new resources, both to agriculture and commerce; to cement more closely the union of the States; to add to their security against foreign attack; to establish public order on the basis of an upright and liberal policy;—these are the great and invaluable ends to be secured by a proper and adequate provision, at the present period, for the support of public credit.

To this provision we are invited, not only by the general considerations which have been noticed, but by others of a more particular nature. It will procure, to every class of the community, some important advantages, and remove some no less important disadvantages.

The advantage to the public creditors, from the increased value of that part of their property which constitutes the public debt, needs no explanation.

[233]

But there is a consequence of this, less obvious, though not less true, in which every other citizen is interested. It is a well-known fact, that, in countries in which the national debt is properly funded, and an object of established confidence, it answers most of the purposes of money. Transfers of stock or public debt are there equivalent to payments in specie; or, in other words, stock, in the principal transactions of business, passes current as specie. The same thing would, in all probability, happen here under the like circumstances.

The benefits of this are various and obvious:

First.—Trade is extended by it, because there is a larger capital to carry it on, and the merchant can, at the same time, afford to trade for smaller profits; as his stock, which, when unemployed, brings him an interest from the Government, serves him also as money when he has a call for it in his commercial operations.

Secondly.—Agriculture and manufactures are also promoted by it, for the like reason, that more capital can be commanded to be employed in both; and because the merchant, whose enterprise in foreign trade gives to them activity and extension, has greater means for enterprise.

Thirdly.—The interest of money will be lowered by it; for this is always in a ratio to the quantity of money, and to the quickness of circulation. This circumstance will enable both the public and individuals to borrow on easier and cheaper terms.

And from the combination of these effects, additional aids will be furnished to labor, to industry, [234] and to arts of every kind. But these good effects of a public debt are only to be looked for, when, by being well funded, it has acquired an adequate and stable value; till then, it has rather a contrary tendency. The fluctuation and insecurity incident to it, in an unfunded state, render it a mere commodity, and a precarious one. As such, being only an object of occasional and particular speculation, all the money applied to it is so much diverted from the more useful channels of circulation, for which the thing itself affords no substitute; so that, in fact, one serious inconvenience of an unfunded debt is, that it contributes to the scarcity of money.

This distinction, which has been little if at all attended to, is of the greatest moment; it involves a question immediately interesting to every part of the community, which is no other than this: Whether the public debt, by a provision for it on true principles, shall be rendered a substitute for money; or whether, by being left as it is, or by being provided for in such a manner as will wound those principles and destroy confidence, it shall be suffered to continue as it is, a pernicious drain of our cash from the channels of productive industry?

The effect which the funding of the public debt, on right principles, would have upon landed property, is one of the circumstances attending such an arrangement, which has been least adverted to, though it deserves the most particular attention. The present depreciated state of that species of property is a serious calamity. The value of cultivated lands, in most of the States, has fallen, since [235] the Revolution, from twenty-five to fifty per cent. In those farther south, the decrease is still more considerable. Indeed, if the representations continually received from that quarter may be credited, lands there will command no price which may not be deemed an almost total sacrifice. This decrease in the value of lands ought, in a great measure, to be attributed to the scarcity of money; consequently, whatever produces an augmentation of the moneyed capital of the country must have a proportional effect in raising that value. The beneficial tendency of a funded debt, in this respect, has been manifested by the most decisive experience in Great Britain.

The proprietors of lands would not only feel the benefit of this increase in the value of their property, and of a more prompt and better sale, when they had occasion to sell, but the necessity of selling would be itself greatly diminished. As the same cause would contribute to the facility of loans, there is reason to believe that such of them as are indebted would be able, through that resource, to satisfy their more urgent creditors.

It ought not, however, to be expected that the advantages described as likely to result from funding the public debt would be instantaneous. It might require some time to bring the value of stock to its natural level, and to attach to it that fixed confidence which is necessary to its quality as money. Yet the late rapid rise of the public securities encourages an expectation that the progress of stock, to the desirable point, will be much more [236] expeditious than could have been foreseen. And as, in the meantime, it will be increasing in value, there is room to conclude that it will, from the outset, answer many of the purposes in contemplation. Particularly, it seems to be probable, that from creditors who are not themselves necessitous it will early meet with a ready reception in payment of debts, at its current price.

Having now taken a concise view of the inducements to a proper provision for the public debt, the next inquiry which presents itself is: What ought to be the nature of such a provision? This requires some preliminary discussions.

It is agreed, on all hands, that that part of the debt which has been contracted abroad, and is denominated the foreign debt, ought to be provided for according to the precise terms of the contracts relating to it. The discussions which can arise, therefore, will have reference essentially to the domestic part of it, or to that which has been contracted at home. It is to be regretted that there is not the same unanimity of sentiment on this part as on the other.

The Secretary has too much deference for the opinions of every part of the community not to have observed one, which has more than once made its appearance in the public prints, and which is occasionally to be met with in conversation. It involves this question: Whether a discrimination ought not to be made between original holders of the public securities, and present possessors, by purchase? Those who advocate a discrimination [237] are for making a full provision for the securities of the former at their nominal value, but contend that the latter ought to receive no more than the cost to them, and the interest. And the idea is sometimes suggested of making good the difference to the primitive possessor.

In favor of this scheme it is alleged that it would be unreasonable to pay twenty shillings in the pound to one who had not given more for it than three or four. And it is added that it would be hard to aggravate the misfortune of the first owner, who, probably through necessity, parted with his property at so great a loss, by obliging him to contribute to the profit of the person who had speculated on his distresses.

The Secretary, after the most mature reflection on the force of this argument, is induced to reject the doctrine it contains, as equally unjust and impolitic; as highly injurious, even to the original holders of public securities; as ruinous to public credit.

It is inconsistent with justice, because, in the first place, it is a breach of contract—a violation of the rights of a fair purchaser.

The nature of the contract, in its origin, is that the public will pay the sum expressed in the security, to the first holder or his assignee. The intent in making the security assignable is, that the proprietor may be able to make use of his property, by selling it for as much as it may be worth in the market, and that the buyer may be safe in the purchase.

[238]

Every buyer, therefore, stands exactly in the place of the seller; has the same right with him to the identical sum expressed in the security; and, having acquired that right by fair purchase and in conformity to the original agreement and intention of the Government, his claim cannot be disputed without manifest injustice.

That he is to be considered as a fair purchaser, results from this: whatever necessity the seller may have been under, was occasioned by the Government, in not making a proper provision for its debts. The buyer had no agency in it, and therefore ought not to suffer. He is not even chargeable with having taken an undue advantage. He paid what the commodity was worth in the market, and took the risks of reimbursement upon himself. He, of course, gave a fair equivalent, and ought to reap the benefit of his hazard—a hazard which was far from inconsiderable, and which, perhaps, turned on little less than a revolution in government.

That the case of those who parted with their securities from necessity is a hard one, cannot be denied. But, whatever complaint of injury, or claim of redress, they may have, respects the Government solely. They have not only nothing to object to the persons who relieved their necessities, by giving them the current price of their property, but they are even under an implied condition to contribute to the reimbursement of those persons. They knew that, by the terms of the contract with themselves, the public were bound to pay to those to whom they should convey their title the sums stipulated to be [239] paid to them; and that, as citizens of the United States, they were to bear their proportion of the contribution for that purpose. This, by the act of assignment, they tacitly engaged to do; and, if they had an option, they could not, with integrity or good faith, refuse to do it, without the consent of those to whom they sold.

But, though many of the original holders sold from necessity, it does not follow that this was the case with all of them. It may well be supposed that some of them did it either through want of confidence in an eventual provision, or from the allurements of some profitable speculation. How shall these different classes be discriminated from each other? How shall it be ascertained, in any case, that the money which the original holder obtained for his security was not more beneficial to him, than if he had held it to the present time, to avail himself of the provision which shall be made? How shall it be known whether, if the purchaser had employed his money in some other way, he would not be in a better situation than by having applied it in the purchase of securities, though he should now receive their full amount? And, if neither of these things can be known, how shall it be determined, whether a discrimination, independent of the breach of contract, would not do a real injury to purchasers; and, if it included a compensation to the primitive proprietors, would not give them an advantage to which they had no equitable pretension?

It may well be imagined, also, that there are not [240] wanting instances in which individuals, urged by a present necessity, parted with the securities received by them from the public, and shortly after replaced them with others, as an indemnity for their first loss. Shall they be deprived of the indemnity which they have endeavored to secure by so provident an arrangement?

Questions of this sort, on a close inspection, multiply themselves without end, and demonstrate the injustice of a discrimination, even on the most subtile calculations of equity, abstracted from the obligation of contract.

The difficulties, too, of regulating the details of a plan for that purpose, which would have even the semblance of equity, would be found immense. It may well be doubted, whether they would not be insurmountable, and replete with such absurd as well as inequitable consequences, as to disgust even the proposers of the measure.

As a specimen of its capricious operation, it will be sufficient to notice the effect it would have upon two persons, who may be supposed, two years ago, to have purchased, each, securities, at three shillings in the pound, and one of them to retain those bought by him, till the discrimination should take place; the other, to have parted with those bought by him, within a month past, at nine shillings. The former, who had had most confidence in the Government, would, in this case, only receive at the rate of three shillings, and the interest; while the latter, who had had less confidence, would receive, for what cost him the same money, at the rate of nine [241] shillings, and his representative, standing in his place, would be entitled to a like rate.

The impolicy of a discrimination results from two considerations: one, that it proceeds upon a principle destructive of that quality of the public debt, or the stock of the nation, which is essential to its capacity for answering the purposes of money—that is, the security of transfer; the other, that, as well on this account as because it includes a breach of faith, it renders property in the funds less valuable, consequently induces lenders to demand a higher premium for what they lend, and produces every other inconvenience of a bad state of public credit.

It will be perceived, at first sight, that the transferable quality of stock is essential to its operation as money, and that this depends on the idea of complete security to the transferee, and a firm persuasion that no distinction can, in any circumstances, be made between him and the original proprietor.

The precedent of an invasion of this fundamental principle would, of course, tend to deprive the community of an advantage with which no temporary saving could bear the least comparison.

And it will as readily be perceived that the same cause would operate a diminution of the value of stock in the hands of the first as well as of every other holder. The price which any man who should incline to purchase would be willing to give for it, would be in a compound ratio to the immediate profit it afforded, and the chance of the continuance of his profit. If there was supposed to be [242] any hazard of the latter, the risk would be taken into the calculation, and either there would be no purchase at all, or it would be at a proportionably less price.

For this diminution of the value of stock every person who should be about to lend to the Government would demand compensation, and would add to the actual difference between the nominal and the market value an equivalent for the chance of greater decrease, which, in a precarious state of public credit, is always to be taken into the account. Every compensation of this sort, it is evident, would be an absolute loss to the Government.

In the preceding discussion of the impolicy of a discrimination, the injurious tendency of it to those who continue to be the holders of the securities they received from the Government has been explained. Nothing need be added on this head, except that this is an additional and interesting light in which the injustice of the measure may be seen. It would not only divest present proprietors, by purchase, of the rights they had acquired under the sanction of public faith, but it would depreciate the property of the remaining original holders. It is equally unnecessary to add any thing to what has been already said to demonstrate the fatal influence which the principle of discrimination would have on the public credit.

But there is still a point of view, in which it will appear perhaps even more exceptionable than in either of the former. It would be repugnant to an express provision of the Constitution of the United [243] States. This provision is that “all debts contracted and engagements entered into before the adoption of that Constitution, shall be as valid against the United States under it as under the Confederation”; which amounts to a constitutional ratification of the contracts respecting the debt in the state in which they existed under the Confederation. And, resorting to that standard, there can be no doubt that the rights of assignees and original holders must be considered as equal. In exploding thus fully the principle of discrimination, the Secretary is happy in reflecting that he is only the advocate of what has been already sanctioned by the formal and express authority of the Government of the Union in these emphatic terms: “The remaining class of creditors,” say Congress, in their circular addressed to the States of the 26th April, 1783, “is composed of such of our fellow-citizens as originally lent to the public the use of their funds, or have since manifested most confidence in their country by receiving transfers from the lenders; and partly of those whose property has been either advanced or assumed for the public service. To discriminate the merits of these several descriptions of creditors would be a task equally unnecessary and invidious. If the voice of humanity pleads more loudly in favor of some than of others, the voice of policy, no less than of justice, pleads in favor of all. A wise nation will never permit those who relieve the wants of their country, or who rely most on its faith, its firmness, and its resources, when either of them is distrusted, to suffer by the event.”

[244]

The Secretary, concluding that a discrimination between the different classes of creditors of the United States cannot, with propriety, be made, proceeds to examine whether a difference ought to be permitted to remain between them and another description of public creditors—those of the States individually. The Secretary, after mature reflection on this point, entertains a full conviction that an assumption of the debts of the particular States by the Union, and a like provision for them as for those of the Union, will be a measure of sound policy and substantial justice.

It would, in the opinion of the Secretary, contribute, in an eminent degree, to an orderly, stable, and satisfactory arrangement of the national finances. Admitting, as ought to be the case, that a provision must be made, in some way or other, for the entire debt, it will follow that no greater revenues will be required whether that provision be made wholly by the United States, or partly by them and partly by the States separately.

The principal question, then, must be whether such a provision cannot be more conveniently and effectually made by one general plan, issuing from one authority, than by different plans, originating in different authorities? In the first case there can be no competition for resources; in the last there must be such a competition. The consequences of this, without the greatest caution on both sides, might be interfering regulations, and thence collision and confusion. Particular branches of industry might also be oppressed by it. The most productive objects of [245] revenue are not numerous. Either these must be wholly engrossed by one side, which might lessen the efficacy of the provisions by the other, or both must have recourse to the same objects, in different modes, which might occasion an accumulation upon them beyond what they could properly bear. If this should not happen, the caution requisite to avoiding it would prevent the revenue’s deriving the full benefit of each object. The danger of interference and of excess would be apt to impose restraints very unfriendly to the complete command of those resources which are the most convenient, and to compel the having recourse to others, less eligible in themselves and less agreeable to the community. The difficulty of an effectual command of the public resources, in case of separate provisions for the debt, may be seen in another, and, perhaps, more striking light. It would naturally happen that different States, from local considerations, would, in some instances, have recourse to different objects, in others to the same objects, in different degrees, for procuring the funds of which they stood in need. It is easy to conceive how this diversity would affect the aggregate revenue of the country. By the supposition, articles which yielded a full supply in some States would yield nothing, or an insufficient product, in others. And hence, the public revenue would not derive the full benefit of those articles from State regulations; neither could the deficiencies be made good by those of the Union. It is a provision of the national Constitution that “all duties, imposts, and excises shall be uniform throughout [246] the United States.” And, as the General Government would be under a necessity, from motives of policy, of paying regard to the duty which may have been previously imposed upon any article, though but in a single State, it would be constrained either to refrain wholly from any further imposition upon such article, where it had been already rated as high as was proper, or to confine itself to the difference between the existing rate and what the article would reasonably bear. Thus the pre-occupancy of an article by a single State would tend to arrest or abridge the impositions of the Union on that article. And as it is supposable that a great variety of articles might be placed in this situation, by dissimilar arrangements of the particular States, it is evident that the aggregate revenue of the country would be likely to be very materially contracted by the plan of separate provisions.

If all the public creditors receive their dues from one source, distributed with an equal hand, their interest will be the same. And, having the same interests, they will unite in the support of the fiscal arrangements of the Government—as these, too, can be made with more convenience where there is no competition. These circumstances combined will insure to the revenue laws a more ready and more satisfactory execution.

If, on the contrary, there are distinct provisions, there will be distinct interests, drawing different ways. That union and concert of views among the creditors, which in every Government is of great importance to their security and to that of public [247] credit, will not only not exist, but will be likely to give place to mutual jealousy and opposition. And from this cause the operation of the systems which may be adopted, both by the particular States and by the Union, with relation to their respective debts, will be in danger of being counteracted.

There are several reasons which render it probable that the situation of the State creditors would be worse than that of the creditors of the Union, if there be not a national assumption of the State debts. Of these it will be sufficient to mention two: one, that a principal branch of revenue is exclusively vested in the Union; the other, that a State must always be checked in the imposition of taxes on articles of consumption, from the want of power to extend the same regulation to the other States, and from the tendency of partial duties to injure its industry and commerce. Should the State creditors stand upon a less eligible footing than the others, it is unnatural to expect they would see with pleasure a provision for them. The influence which their dissatisfaction might have, could not but operate injuriously, both for the creditors and the credit of the United States. Hence it is even the interest of the creditors of the Union, that those of the individual States should be comprehended in a general provision. Any attempt to secure to the former either exclusive or peculiar advantages, would materially hazard their interests. Neither would it be just that one class of public creditors should be more favored than the other. The objects for which both descriptions of the debt were contracted are in the [248] main the same. Indeed, a great part of the particular debts of the States has arisen from assumptions by them on account of the Union. And it is most equitable that there should be the same measure of retribution for all. There is an objection, however, to an assumption of the State debts, which deserves particular notice. It may be supposed that it would increase the difficulty of an equitable settlement between them and the United States.

The principles of that settlement, whenever they shall be discussed, will require all the moderation and wisdom of the Government. In the opinion of the Secretary, that discussion, till further lights are obtained, would be premature. All, therefore, which he would now think advisable on the point in question would be that the amount of the debts assumed and provided for should be charged to the respective States to abide an eventual arrangement. This the United States, as assignees to the creditors, would have an indisputable right to do. But, as it might be a satisfaction to the House to have before them some plan for the liquidation of accounts between the Union and its members, which, including the assumption of the State debts, would consist with equity, the Secretary will submit, in this place, such thoughts on the subject as have occurred to his own mind, or been suggested to him, most compatible, in his judgment, with the end proposed.

Let each State be charged with all the money advanced to it out of the treasury of the United States, liquidated according to the specie value at the time of each advance, with interest at six per cent.

[249]

Let it also be charged with the amount, in specie value, of all its securities which shall be assumed, with the interest upon them, to the time when interest shall become payable by the United States.

Let it be credited for all moneys paid and articles furnished to the United States, and for all other expenditures during the war, either toward general or particular defence, whether authorized or unauthorized by the United States; the whole liquidated to specie value, and bearing an interest of six per cent. from the several times at which the several payments, advances, and expenditures accrued.

And let all sums of continental money, now in the treasuries of the respective States, which shall be paid into the treasury of the United States, be credited at specie value.

Upon a statement of the accounts according to these principles, there can be little doubt that balances would appear in favor of all the States against the United States.

To equalize the contributions of the States, let each be then charged with its proportion of the aggregate of those balances, according to some equitable ratio, to be devised for that purpose.

If the contributions should be found disproportionate, the result of this adjustment would be, that some States would be creditors, some debtors, to the Union. Should this be the case—as it will be attended with less inconvenience to the United States to have to pay balances to, than to receive them from, the particular States—it may, perhaps, be practicable to effect the former by a second process, in the nature [250] of a transfer of the amount of the debts of debtor States, to the credit of creditor States, observing the ratio by which the first apportionment shall have been made. This, whilst it would destroy the balances due from the former, would increase those due to the latter; these to be provided for by the United States, at a reasonable interest, but not to be transferable. The expediency of this second process must depend on a knowledge of the result of the first. If the inequalities should be too great, the arrangement may be impracticable, without unduly increasing the debt of the United States. But it is not likely that this would be the case. It is also to be remarked, that though this second process might not, upon the principle of apportionment, bring the thing to the point aimed at, yet it may approach so nearly to it, as to avoid essentially the embarrassment of having considerable balances to collect from any of the States.

The whole of this arrangement to be under the superintendence of commissioners, vested with equitable discretion and final authority. The operation of the plan is exemplified in Schedule A.

The general principle of it seems to be equitable: for it appears difficult to conceive a good reason why the expenses for the particular defence of a part, in a common war, should not be a common charge, as well as those incurred professedly for the general defence. The defence of each part is that of the whole; and unless all the expenditures are brought into a common mass, the tendency must be to add to the calamities suffered, by being the most exposed to [251] the ravages of war, an increase of burthens. This plan seems to be susceptible of no objection which does not belong to every other, that proceeds on the idea of a final adjustment of accounts. The difficulty of settling a ratio is common to all. This must, probably, either be sought for in the proportions of the requisitions during the war, or in the decision of commissioners, appointed with plenary power. The rule prescribed in the Constitution, with regard to representation and direct taxes, would evidently not be applicable to the situation of parties during the period in question. The existing debt of the United States is excluded from the computation, as it ought to be, because it will be provided for out of a general fund. The only discussion of a preliminary kind which remains, relates to the distinctions of the debt into principal and interest. It is well known that the arrears of the latter bear a large proportion to the amount of the former. The immediate payment of these arrears is evidently impracticable; and a question arises, What ought to be done with them?

There is good reason to conclude, that the impressions of many are more favorable to the claim of the principal, than to that of the interest; at least so far as to produce an opinion, that an inferior provision might suffice for the latter.

But, to the Secretary, this opinion does not appear to be well founded. His investigations of the subject have led him to a conclusion, that the arrears of interest have pretensions at least equal to the principal.

[252]

The liquidated debt, traced to its origin, falls under two principal discriminations. One relating to loans, the other to services performed and articles supplied. The part arising from loans was at first made payable at fixed periods, which have long since elapsed, with an early option to lenders, either to receive back their money at the expiration of those periods, or to continue it at interest, till the whole amount of continental bills circulating should not exceed the sum in circulation at the time of each loan. This contingency, in the sense of the contract, never happened; and the presumption is, that the creditors preferred continuing their money indefinitely at interest to receiving it in a depreciated and depreciating state.

The other parts of it were chiefly for objects which ought to have been paid for at the time—that is, when the services were performed, or the supplies furnished; and were not accompanied with any contract for interest.

But by different acts of Government and Administration, concurred in by the creditors, these parts of the debt have been converted into a capital, bearing an interest of six per cent. per annum, but without any definite period of redemption. A portion of the Loan Office debt has been exchanged for new securities of that import; and the whole of it seems to have acquired that character after the expiration of the periods prefixed for repayment. If this view of the subject be a just one, the capital of the debt of the United States may be considered in the light of an annuity at the rate of six per cent. per [253] annum, redeemable at the pleasure of the Government by payment of the principal: for it seems to be a clear position, that, when a Government contracts a debt payable with interest, without any precise time being stipulated or understood for payment of the capital, that time is a matter of pure discretion with the Government, which is at liberty to consult its own convenience respecting it, taking care to pay the interest with punctuality.

Wherefore, as long as the United States should pay the interest of their debt, as it accrued, their creditors would have no right to demand the principal. But with regard to the arrears of interest, the case is different. These are now due, and those to whom they are due, have a right to claim immediate payment. To say that it would be impracticable to comply, would not vary the nature of the right. Nor can this idea of impracticability be honorably carried further than to justify the proposition of a new contract, upon the basis of a commutation of that right for an equivalent. This equivalent, too, ought to be a real and fair one. And what other fair equivalent can be imagined for the detention of money, but a reasonable interest? Or what can be the standard of that interest, but the market rate, or the rate which the Government pays in ordinary cases?

From this view of the matter, which appears to be the accurate and true one, it will follow that the arrears of interest are entitled to an equal provision with the principal of the debt.

The result of the foregoing discussion is this: That [254] there ought to be no discrimination between the original holders of the debt, and present possessors by purchase; that it is expedient there should be an assumption of the State debts by the Union; and that the arrears of interest should be provided for on an equal footing with the principal.

The next inquiry, in order, toward determining the nature of a proper provision, respects the quantum of the debt, and present rates of interest.

The debt of the Union is distinguishable into foreign and domestic.

| The foreign debt, as stated in Schedule B, amounts to, principal . . . | $10,070,307 00 |

| Bearing an interest of four, and partly an interest of five per cent. | |

| Arrears of interest to the last of December, 1789 . . . . . | 1,640,071 62 |

| ——— | |

| Making, together . . | $11,710,378 62 |

The domestic debt may be subdivided into liquidated and unliquidated; principal and interest.

| The principal of the liquidated part, as stated in Schedule C, amounts to . | $27,383,917 74 |

| Bearing an interest of six per cent. | |

| The arrears of interest, as stated in the Schedule D, to the end of 1790, amount to . . . . . | 13,030,168 20 |

| ——— | |

| Making, together . . | $40,414,085 94 |

This includes all that has been paid in indents (except what has come into the treasury of the United [255] States), which, in the opinion of the Secretary, can be considered in no other light than as interest due.

The unliquidated part of the domestic debt, which consists chiefly of the continental bills of credit, is not ascertained, but may be estimated at 2,000,000 dollars.

These several sums constitute the whole of the debt of the United States, amounting together to $54,124,464.56. That of the individual States is not equally well ascertained. The Schedule E shows the extent to which it has been ascertained by returns, pursuant to the orders of the House of the 21st September last; but this not comprehending all the States, the residue must be estimated from less authentic information. The Secretary, however, presumes that the total amount may be safely stated at twenty-five millions of dollars, principal and interest. The present rate of interest in the States’ debt is, in general, the same with that of the domestic debt of the Union.

On the supposition that the arrears of interest ought to be provided for, on the same terms with the principal, the annual amount of the interest, which, at the existing rates, would be payable on the entire mass of the public debt, would be:

| On the foreign debt, computing the interest on the principal, as it stands, and allowing four per cent. on the arrears of interest . . . . . . | $ 542,599 66 |

| On the domestic debt, including that of States . . . . . . | 4,044,845 15 |

| ——— | |

| Making, together . . | $4,587,444 81 |

[256]

The interesting problem now occurs: Is it in the power of the United States, consistently with those prudential considerations which ought not to be overlooked, to make a provision equal to the purpose of funding the whole debt, at the rates of interest which it now bears, in addition to the sum which will be necessary for the current service of the Government?

The Secretary will not say that such a provision would exceed the abilities of the country, but he is clearly of opinion that to make it would require the extension of taxation to a degree and to objects which the true interest of the public creditors forbids. It is, therefore, to be hoped, and even to be expected, that they will cheerfully concur in such modifications of their claims, on fair and equitable principles, as will facilitate to the Government an arrangement substantial, durable, and satisfactory to the community. The importance of the last characteristic will strike every discerning mind. No plan, however flattering in appearance, to which it did not belong, could be truly entitled to confidence.

It will not be forgotten that exigencies may, erelong, arise, which would call for resources greatly beyond what is now deemed sufficient for the current service; and that, should the faculties of the country be exhausted, or even strained, to provide for the public debt, there could be less reliance on the sacredness of the provision. But while the Secretary yields to the force of these considerations, he does not lose sight of those fundamental principles of good faith which dictate that every practicable [257] exertion ought to be made, scrupulously to fulfil the engagements of the Government; that no change in the rights of its creditors ought to be attempted without their voluntary consent; and that this consent ought to be voluntary in fact as well as in name. Consequently, that every proposal of a change ought to be in the shape of an appeal to their reason and to their interest, not to their necessities. To this end it is requisite that a fair equivalent should be offered for what may be asked to be given up, and unquestionable security for the remainder. Without this, an alteration consistently with the credit and honor of the nation would be impracticable.

It remains to see what can be proposed in conformity to these views.

It has been remarked that the capital of the debt of the Union is to be viewed in the light of an annuity, at the rate of six per cent. per annum, redeemable at the pleasure of the Government by payment of the principal. And it will not be required that the arrears of interest should be considered in a more favorable light. The same character, in general, may be applied to the debts of the individual States.

This view of the subject admits that the United States would have it in their power to avail themselves of any fall in the market rate of interest for reducing that of the debt.

This property of the debt is favorable to the public, unfavorable to the creditor, and may facilitate an arrangement for the reduction of interest upon the basis of a fair equivalent.

Probabilities are always a rational ground of [258] contract. The Secretary conceives that there is good reason to believe, if effectual measures are taken to establish public credit, that the Government rate of interest in the United States will, in a very short time, fall at least as low as five per cent.; and that, in a period not exceeding twenty years, it will sink still lower, probably to four. There are two principal causes which will be likely to produce this effect: one, the low rate of interest in Europe; the other, the increase of the moneyed capital of the nation by the funding of the public debt.

From three to four per cent. is deemed good interest in several parts of Europe. Even less is deemed so in some places; and it is on the decline, the increasing plenty of money continually tending to lower it. It is presumable, that no country will be able to borrow of foreigners upon better terms than the United States, because none can, perhaps, afford so good security. Our situation exposes us, less than that of any other nation, to those casualties which are the chief causes of expense; our encumbrances, in proportion to our real means, are less, though these cannot immediately be brought so readily into action; and our progress in resources, from the early state of the country, and the immense tracts of unsettled territory, must necessarily exceed that of any other. The advantages of this situation have already engaged the attention of the European money-lenders, particularly among the Dutch. And as they become better understood, they will have the greater influence. Hence, as large a proportion of the cash of Europe as may be wanted will be, in a [259] certain sense, in our market, for the use of Government. And this will naturally have the effect of a reduction of the rate of interest, not indeed to the level of the places which send their money to market, but to something much nearer to it than our present rate.

The influence which the funding of the debt is calculated to have in lowering interest has been already remarked and explained. It is hardly possible that it should not be materially affected by such an increase of the moneyed capital of the nation as would result from the proper funding of seventy millions of dollars. But the probability of a decrease in the rate of interest acquires confirmation from facts which existed prior to the Revolution. It is well known that, in some of the States, money might, with facility, be borrowed, on good security, at five per cent., and, not unfrequently, even at less.

The most enlightened of the public creditors will be most sensible of the justness of this view of the subject, and of the propriety of the use which will be made of it. The Secretary, in pursuance of it, will assume, as a probability sufficiently great to be a ground of calculation, both on the part of the Government and of its creditors, that the interest of money in the United States will, in five years, fall to five per cent., and, in twenty, to four. The probability, in the mind of the Secretary, is rather that the fall may be more rapid and more considerable; but he prefers a mean, as most likely to engage the assent of the creditors, and more equitable in itself; [260] because it is predicated on probabilities, which may err on one side as well as on the other.

Premising these things, the Secretary submits to the House the expediency of proposing a loan, to the full amount of the debt, as well of the particular States as of the Union, upon the following terms:

First. That, for every hundred dollars subscribed, payable in the debt (as well interest as principal), the subscriber be entitled, at his option, either to have two thirds funded at an annuity or yearly interest of six per cent., redeemable at the pleasure of the Government by payment of the principal, and to receive the other third in lands in the Western territory, at the rate of twenty cents per acre; or to have the whole sum funded at an annuity or yearly interest of four per cent., irredeemable by any payment exceeding five dollars per annum, on account both of principal and interest, and to receive, as a compensation for the reduction of interest, fifteen dollars and eighty cents, payable in lands, as in the preceding case; or to have sixty-six dollars and two thirds of a dollar funded immediately, at an annuity or yearly interest of six per cent., irredeemable by any payment exceeding four dollars and two thirds of a dollar per annum, on account both of principal and interest, and to have, at the end of ten years, twenty-six dollars and eighty-eight cents funded at the like interest and rate of redemption; or to have an annuity, for the remainder of life, upon the contingency of fixing to a given age, not less distant than ten years, computing interest at four per cent.; or to have an annuity for the remainder of life, upon the [261] contingency of the survivorship of the younger of two persons, computing interest in this case also at four per cent.

In addition to the foregoing loan, payable wholly in the debt, the Secretary would propose that one should be opened for ten millions of dollars, on the following plan:

That, for every hundred dollars subscribed, payable one half in specie and the other half in debt (as well principal as interest), the subscriber be entitled to an annuity or yearly interest of five per cent., irredeemable by any payment exceeding six dollars per annum, on account both of principal and interest.

The principles and operation of these different plans may now require explanation.

The first is simply a proposition for paying one third of the debt in land, and funding the other two thirds at the existing rate of interest and upon the same terms of redemption to which it is at present subject.

Here is no conjecture, no calculation of probabilities. The creditor is offered the advantage of making his interest principal, and he is asked to facilitate to the Government an effectual provision for his demands, by accepting a third part of them in land, at a fair valuation.

The general price at which the Western lands have been heretofore sold, has been a dollar per acre in public securities; but, at the time the principal purchases were made, these securities were worth, in the market, less than three shillings in the pound. The nominal price, therefore, would not be the proper [262] standard, under present circumstances, nor would the precise specie value then given be a just rule; because, as the payments were to be made by instalments, and the securities were, at the times of the purchases, extremely low, the probability of a moderate rise must be presumed to have been taken into the account.

Twenty cents, therefore, seems to bear an equitable proportion to the two considerations of value at the time and likelihood of increase.

It will be understood that, upon this plan, the public retains the advantage of availing itself of any fall in the market rate of interest, for reducing that upon the debt; which is perfectly just, as no present sacrifice, either in the quantum of the principal, or in the rate of interest, is required from the creditor.

The inducement to the measure is, the payment of one third of the debt in land. The second plan is grounded upon the supposition that interest, in five years, will fall to five per cent.; in fifteen more, to four. As the capital remains entire, but bearing an interest of four per cent. only, compensation is to be made to the creditor for the interest of two per cent. per annum for five years, and of one per cent. per annum for fifteen years, to commence at the distance of five years. The present value of these two sums or annuities, computed according to the terms of the supposition, is, by strict calculation, fifteen dollars and the seven hundred and ninety-two thousandth part of a dollar—a fraction less than the sum proposed.

The inducements of the measure here, are the [263] reduction of interest to a rate more within the compass of a convenient provision, and the payment of the compensation in lands.

The inducements to the individual are, the accommodation afforded to the public; the high probability of a complete equivalent; the chance even of gain, should the rate of interest fall, either more speedily or in a greater degree than the calculation supposes. Should it fall to five per cent. sooner than five years, should it fall lower than five before the additional fifteen were expired, or should it fall below four previous to the payment of the debt, there would be, in each case, an absolute profit to the creditor. As his capital will remain entire, the value of it will increase with every decrease of the rate of interest.

The third plan proceeds upon the like supposition of a successive fall in the rate of interest, and upon that supposition offers an equivalent to the creditor: One hundred dollars, bearing an interest of six per cent. for five years, or five per cent. for fifteen years, and thenceforth of four per cent. (these being the successive rates of interest in the market), is equal to a capital of $122.510725 parts, bearing an interest of four per cent., which, converted into a capital bearing a fixed rate of interest of six per cent., is equal to $81.6738166 parts.

The difference between sixty-six dollars and two thirds of a dollar (the sum to be funded immediately) and this last sum is $15.0172 parts, which, at six per cent. per annum, amounts, at the end of ten years, to $26.8755 parts—the sum to be funded at the [264] expiration of that period. It ought, however, to be acknowledged that this calculation does not make allowance for the principle of redemption, which the plan itself includes; upon which principle, the equivalent, in a capital of six per cent., would be, by strict calculation, $87.50766 parts.

But there are two considerations which induce the Secretary to think that the one proposed would operate more equitably than this: One is, that it may not be very early in the power of the United States to avail themselves of the right of redemption reserved in the plan; the other is, that with regard to the part to be funded at the end of ten years, the principle of redemption is suspended during that time, and the full interest of six per cent. goes on improving at the same rate, which, for the last five years, will exceed the market rate of interest, according to the supposition.

The equivalent is regulated in this plan by the circumstance of fixing the rate of interest higher than it is supposed it will continue to be in the market, permitting only a gradual discharge of the debt, in an established proportion, and consequently preventing advantage being taken of any decrease of interest below the stipulated rate.

Thus the true value of eighty-one dollars and sixty-seven cents, the capital proposed, considered as a perpetuity, and bearing six per cent. interest, when the market rate of interest was five per cent., would be a small fraction more than ninety-eight dollars; when it was four per cent., it would be one hundred and twenty-two dollars and fifty-one cents. [265] But the proposed capital being subject to gradual redemption, it is evident that its value, in each case, would be somewhat less. Yet, from this may be perceived the manner in which a less capital, at a fixed rate of interest, becomes an equivalent for a greater capital, at a rate liable to variation and diminution.

It is presumable that those creditors who do not entertain a favorable opinion of property in Western lands will give a preference to this last mode of modelling the debt. The Secretary is sincere in affirming that, in his opinion, it will be likely to prove, to the full, as beneficial to the creditor as a provision for his debt upon its present terms.

It is not intended, in either case, to oblige the Government to redeem in the proportion specified, but to secure to it the right of doing so, to avoid the inconvenience of a perpetuity.

The fourth and fifth plans abandon the supposition which is the basis of the two preceding ones, and offer only four per cent. throughout.

The reason of this is, that the payment being deferred, there will be an accumulation of compound interest, in the intermediate period, against the public, which, without a very provident administration, would turn to its detriment, and the suspension of the burthen would be too apt to beget a relaxation of efforts in the meantime. The measure, therefore, its object being temporary accommodation, could only be advisable upon a moderate rate of interest.

With regard to individuals, the inducement will be sufficient at four per cent. There is no disposition [266] of money, in private loans, making allowance for the usual delays and casualties, which would be equally beneficial as a future provision.

A hundred dollars advanced upon the life of a person of eleven years old would produce an annuity1—

| Dolls. Parts. | |

|---|---|

| If commencing at twenty-one, of . . | 10.346 |

| If commencing at thirty-one, of . . | 18.803 |

| If commencing at forty-one, of . . | 37.286 |

| If commencing at fifty-one, of . . . | 78.580 |

The same sum advanced upon the chance of the survivorship of the younger of two lives, one of the persons being twenty-five, the other thirty years old, would produce, if the younger of the two should survive, an annuity2 for the remainder of life, of twenty-three dollars, five hundred and fifty-six parts.

From these instances may readily be discerned the advantages which these deferred annuities afford, for securing a comfortable provision for the evening of life, or for wives who survive their husbands.

The sixth plan also relinquishes the supposition, which is the foundation of the second and third, and offers a higher rate of interest, upon similar terms of redemption, for the consideration of the payment of one half of the loan in specie. This is a plan highly advantageous to the creditors who may be able to make that payment, while the specie itself could be applied in purchases of the debt, upon terms which [267] would fully indemnify the public for the increased interest.

It is not improbable that foreign holders of the domestic debt may embrace this as a desirable arrangement.

As an auxiliary expedient, and by way of experiment, the Secretary would propose a loan upon the principles of a tontine1—

To consist of six classes, composed respectively of persons of the following ages:

First class, of those of 20 years and under.

Second class, of those above 20, and not exceeding 30.

Third class, of those above 30, and not exceeding 40.

Fourth class, of those above 40, and not exceeding 50.

Fifth class, of those above 50, and not exceeding 60.

Sixth class, of those above 60.

Each share to be two hundred dollars; the number of shares in each class to be indefinite. Persons to be at liberty to subscribe on their own lives, or on those of others nominated by them.

| The annuity upon a share in the first class, to be | $ 8 40 |

| Upon a share in the second . . . . | 8 65 |

| Upon a share in the third . . . . | 9 00 |

| Upon a share in the fourth . . . . | 9 65 |

| Upon a share in the fifth . . . . . | 10 70 |

| Upon a share in the sixth . . . . . | 12 80 |

[268]

The annuities of those who die to be equally divided among the survivors, until four fifths shall be dead, when the principle of survivorship shall cease, and each annuitant thenceforth enjoy his dividend as a several annuity during the life upon which it shall depend.

These annuities are calculated on the best life in each class, and at a rate of interest of four per cent., with some deductions in favor of the public. To the advantages which these circumstances present, the cessation of the right of survivorship, on the death of four fifths of the annuitants, will be no inconsiderable addition.

The inducements to individuals are, a competent interest for their money from the outset, secured for life, with a prospect of continual increase, and even of a large profit to those whose fortune it is to survive their associates.

It will have appeared that, in all the proposed loans, the Secretary has contemplated the putting the interest upon the same footing with the principal. That on the debt of the United States, he would have computed to the last of the present year; that on the debt of the particular States, to the last of the year 1791: the reason for which distinction will be seen hereafter.

In order to keep up a due circulation of money, it will be expedient that the interest of the debt should be paid quarter-yearly. This regulation will, at the same time, conduce to the advantage of the public creditors, giving them, in fact, by the anticipation of payment, a higher rate of interest; which may, with [269] propriety, be taken into the estimate of the compensation to be made to them. Six per cent. per annum, paid in this mode, will truly be worth six dollars and the one hundred and thirty-five thousandth part of a dollar, computing the market interest at the same rate.

The Secretary thinks it advisable to hold out various propositions, all of them compatible with the public interest, because it is, in his opinion, of the greatest consequence that the debt should, with the consent of the creditors, be remoulded into such a shape as will bring the expenditure of the nation to a level with its income. Till this shall be accomplished the finances of the United States will never wear a proper countenance. Arrears of interest, continually accruing, will be as continual a monument, either of inability or of ill faith, and will not cease to have an evil influence on public credit. In nothing are appearances of greater moment than in whatever regards credit. Opinion is the soul of it; and this is affected by appearances as well as realities. By offering an option to the creditors between a number of plans, the change meditated will be more likely to be accomplished. Different tempers will be governed by different views of the subject.

But while the Secretary would endeavor to effect a change in the form of the debt by new loans, in order to render it more susceptible of an adequate provision, he would not think it proper to aim at procuring the concurrence of the creditors by operating upon their necessities.

Hence, whatever surplus of revenue might remain, [270] after satisfying the interest of the new loans and the demand for the current service, ought to be divided among those creditors, if any, who may not think fit to subscribe to them. But for this purpose, under the circumstance of depending propositions, a temporary appropriation will be most advisable, and the sum must be limited to four per cent., as the revenues will only be calculated to produce in that proportion to the entire debt.

The Secretary confides, for the success of the propositions to be made, on the goodness of the reasons upon which they rest; on the fairness of the equivalent to be offered in each case; on the discernment of the creditors of their true interest, and on their disposition to facilitate the arrangements of the Government, and to render them satisfactory to the community.

The remaining part of the task to be performed is to take a view of the means of providing for the debt, according to the modification of it which is proposed.

On this point the Secretary premises that, in his opinion, the funds to be established ought, for the present, to be confined to the existing debt of the United States; as well because the progressive augmentation of the revenue will be most convenient, as because the consent of the State creditors is necessary to the assumption contemplated; and though the obtaining of that consent may be inferred with great assurance from their obvious interest to give it, yet, till it shall be obtained, an actual provision for the debt would be premature. Taxes could not, with [271] propriety, be laid for an object which depended on such a contingency.

All that ought now to be done respecting it is to put the matter in an effectual train for a future provision. For which purpose the Secretary will, in the course of this report, submit such propositions as appear to him advisable.

The Secretary now proceeds to a consideration of the necessary funds.

| It has been stated that the debt of the United States consists of the foreign debt, amounting, with arrears of interest, to . . . . . | $11,710,378 62 |

| And the domestic debt, amounting, with like arrears, computed to the end of the year 1790, to . . . . | 42,414,085 94 |

| ——— | |

| Making, together . . | $54,124,464 56 |

The interest on the domestic debt is computed to the end of this year, because the details of carrying any plan into execution will exhaust the year.

| The annual interest of the foreign debt has been stated at . . . . | $ 542,599 66 |

| And the interest on the domestic debt, at four per cent., would amount to . . . . . | 1,696,563 43 |

| ——— | |

| Making, together . . | $2,239,163 09 |

Thus, to pay the interest of the foreign debt, and to pay four per cent. on the whole of the domestic debt, principal and interest, forming a new capital, will require a yearly income of $2,239,163.09—the [272] sum which, in the opinion of the Secretary, ought now to be provided, in addition to what the current service will require.

For, though the rate of interest proposed by the third plan exceeds four per cent. on the whole debt and the annuities on the tontine will also exceed four per cent. on the sums which may be subscribed; yet, as the actual provision for a part is in the former case suspended, as measures for reducing the debt by purchases may be advantageously pursued, and as the payment of the deferred annuities will of course be postponed, four per cent. on the whole will be a sufficient provision.

With regard to the instalments of the foreign debt, these, in the opinion of the Secretary, ought to be paid by new loans abroad. Could funds be conveniently spared from other exigencies for paying them, the United States could illy bear the drain of cash, at the present juncture, which the measure would be likely to occasion.

But to the sum which has been stated for payment of the interest must be added a provision for the current service. This the Secretary estimates at six hundred thousand dollars,1 making, with the amount of the interest, two millions eight hundred and thirty-nine thousand one hundred and sixty-three dollars and nine cents.

This sum may, in the opinion of the Secretary, be obtained from the present duties on imports and tonnage, with the additions which, without any possible disadvantage, either to trade or agriculture, [273] may be made on wines, spirits (including those distilled within the United States), teas, and coffee.

The Secretary conceives that it will be sound policy to carry the duties upon articles of this kind as high as will be consistent with the practicability of a safe collection. This will lessen the necessity, both of having recourse to direct taxation, and of accumulating duties where they would be more inconvenient to trade and upon objects which are more to be regarded as necessaries of life.

That the articles which have been enumerated will, better than most others, bear high duties, can hardly be a question. They are all of them in reality luxuries; the greatest part of them foreign luxuries; some of them, in the excess in which they are used, pernicious luxuries. And there is, perhaps, none of them which is not consumed in so great abundance as may justly denominate it a source of national extravagance and impoverishment. The consumption of ardent spirits, particularly, no doubt very much on account of their cheapness, is carried to an extreme which is truly to be regretted, as well in regard to the health and morals as to the economy of the community.

Should the increase of duties tend to a decrease of the consumption of those articles, the effect would be in every respect desirable. The saving which it would occasion would leave individuals more at their ease, and promote a favorable balance of trade. As far as this decrease might be applicable to distilled spirits, it would encourage the substitution of [274] cider and malt liquors, benefit agriculture, and open a new and productive source of revenue.

It is not, however, probable that this decrease would be in a degree which would frustrate the expected benefit to the revenue from raising the duties. Experience has shown that luxuries of every kind lay the strongest hold on the attachments of mankind, which, especially when confirmed by habit, are not easily alienated from them.

The same fact affords a security to the merchant that he is not likely to be prejudiced by considerable duties on such articles. They will usually command a proportional price. The chief things, in this view, to be attended to, are, that the terms of payment be so regulated as not to require inconvenient advances, and that the mode of collection be secure.

To other reasons, which plead for carrying the duties upon the articles which have been mentioned, to as great an extent as they will bear, may be added these: that they are of a nature, from their extensive consumption, to be very productive, and are amongst the most difficult objects of illicit introduction.

Invited by so many motives to make the best use of the resource which these articles afford, the essential inquiry is, in what mode can the duties upon them be most effectually collected?

With regard to such of them as will be brought from abroad, a duty on importation recommends itself by two leading considerations: one is, that, meeting the object at its first entrance into the country, the collection is drawn to a point, and, so [275] far, simplified; the other is, that it avoids the possibility of interference between the regulations of the United States and those of the particular States.

But a duty, the precautions for the collection of which should terminate with the landing of the goods, as is essentially the case in the existing system, could not, with safety, be carried to the extent which is contemplated.

In that system, the evasion of the duty depends, as it were, on a single risk. To land the goods in defiance of the vigilance of the officers of the customs, is almost the sole difficulty. No future pursuit is materially to be apprehended. And where the inducement is equivalent to the risk, there will be found too many who are willing to run it. Consequently, there will be extensive frauds of the revenue, against which the utmost rigor of penal laws has proved, as often as it has been tried, an ineffectual guard.

The only expedient which has been discovered, for conciliating high duties with a safe collection, is the establishment of a second or interior scrutiny.

By pursuing the article, from its importation into the hands of the dealers in it, the risk of detection is so greatly enhanced, that few, in comparison, will venture to incur it. Indeed, every dealer who is not himself the fraudulent importer, then becomes in some sort a sentinel upon him.

The introduction of a system founded on this principle in some shape or other, is, in the opinion of the Secretary, essential to the efficacy of every attempt to render the revenues of the United States [276] equal to their exigencies, their safety, their prosperity, their honor.

Nor is it less essential to the interest of the honest and fair trader. It might even be added, that every individual citizen, besides his share in the general weal, has a particular interest in it. The practice of smuggling never fails to have one of two effects, and sometimes unites them both. Either the smuggler undersells the fair trader, as, by saving the duty, he can afford to do, and makes it a charge upon him, or he sells at the increased price occasioned by the duty, and defrauds every man who buys of him, of his share of what the public ought to receive; for it is evident that the loss falls ultimately upon the citizens, who must be charged with other taxes to make good the deficiency and supply the wants of the State.

The Secretary will not presume that the plan which he shall submit to the consideration of the House is the best that could be devised. But it is the one which has appeared to him freest from objections, of any that has occurred, of equal efficacy. He acknowledges, too, that it is susceptible of improvement, by other precautions in favor of the revenue, which he did not think it expedient to add. The chief outlines of the plan are not original; but it is no ill recommendation of it, that it has been tried with success.

The Secretary accordingly proposes—

That the duties heretofore laid upon wines, distilled spirits, teas, and coffee, should, after the last day of May next, cease; and that, instead of them, the following duties be laid:

[277]

Upon every gallon of Madeira wine, the quality of London particular, thirty-five cents.

Upon every gallon of other Madeira wine, thirty cents.

Upon every gallon of Sherry, twenty-five cents.

Upon every gallon of other wine, twenty cents.

Upon every gallon of distilled spirits more than ten per cent. below proof, according to Dicas’ hydrometer, twenty cents.

Upon every gallon of those spirits under five and not more than ten per cent. below proof, according to the same hydrometer, twenty-one cents.

Upon every gallon of those spirits, of proof, and not more than five per cent. below proof, according to the same hydrometer, twenty-two cents.

Upon every gallon of those spirits, above proof, but not exceeding twenty per cent. according to the same hydrometer, twenty-five cents.

Upon every gallon of those spirits, more than twenty, and not more than forty per cent. above proof, according to the same hydrometer, thirty cents.

Upon every gallon of those spirits, more than forty per cent. above proof, according to the same hydrometer, forty cents.

Upon every pound of Hyson tea, forty cents.

Upon every pound of other green tea, twenty-four cents.

Upon every pound of Souchong and other black teas, except Bohea, twenty cents.

Upon every pound of Bohea tea, twelve cents.

Upon every pound of coffee, five cents.

[278]

That, upon spirits distilled within the United States, from molasses, sugar, or other foreign materials, there be paid:

Upon every gallon of those spirits, more than ten per cent. below proof, according to Dicas’ hydrometer, eleven cents.

Upon every gallon of those spirits, under five, and not more than ten per cent. below proof, according to the same hydrometer, twelve cents.

Upon every gallon of those spirits, of proof, and not more than five per cent. below proof, according to the same hydrometer, thirteen cents.